The communication doesn’t directly encourage the member to engage in grassroots lobbying (whether individually or through the organization).Įxpenditures for a communication directed to only members that refers to, and reflects a view on, specific legislation and that satisfies the requirements of items (1), (2), and (4), earlier (under Grassroots lobbying communications), but doesn’t satisfy the requirements of item (3), are treated as expenditures for direct lobbying.Įxpenditures for a communication directed to only members that refers to, and reflects a view on, specific legislation and satisfies the requirements of items (1) and (2) earlier, but doesn’t satisfy the requirements of item (4), are treated as grassroots expenditures, whether or not the communication satisfies the requirements of item (3). The communication doesn’t directly encourage the member to engage in direct lobbying (whether individually or through the organization). The specific legislation the communication refers to, and reflects a view on, is of direct interest to the organization and its members. The communication is directed to only members of the organization.

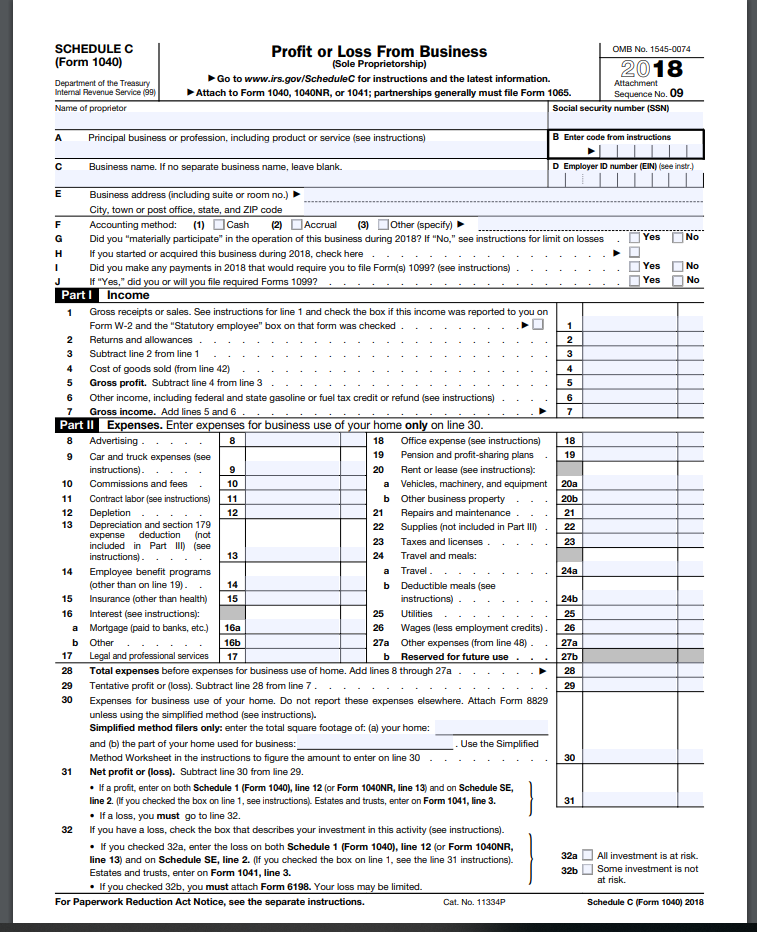

SCHEDULE C TAX FORM FULL

Nonpartisan analysis, study, or research may advocate a particular position or viewpoint as long as there is a sufficiently full and fair exposition of the pertinent facts to enable the public or an individual to form an independent opinion or conclusion.Ī communication that responds to a governmental body's or committee's written request for technical advice isn’t a direct lobbying communication.Ī communication isn’t a direct lobbying communication if the communication is an appearance before, or communication with, any legislative body concerning action by that body that might affect the organization's existence, its powers and duties, its tax-exempt status, or the deductibility of contributions to the organization, as opposed to affecting merely the scope of the organization's future activities. In general, engaging in nonpartisan analysis, study, or research and making its results available to the general public or segment of members thereof, or to governmental bodies, officials, or employees isn’t considered either a direct lobbying communication or a grassroots lobbying communication. Disregarded Entities and Joint Ventures-Inclusion of Activities and Items.

See Instructions for Form 990, Appendix F.

If an organization has an ownership interest in a joint venture that conducts political campaign activities or lobbying activities, the organization must report its share of such activity occurring in its tax year on Schedule C (Form 990). An organization that answered "Yes" on Form 990-EZ, Part V, line 35c, because it is subject to the section 6033(e) notice and reporting requirements and proxy tax, must complete Schedule C (Form 990), Part III, and attach Schedule C to Form 990-EZ. An organization that answered "Yes" on Form 990-EZ, Part V, line 46 or Part VI, line 47, must complete the appropriate parts of Schedule C (Form 990) and attach Schedule C to Form 990-EZ.

An organization that answered "Yes" on Form 990, Part IV, Checklist of Required Schedules, line 3, 4, or 5, must complete the appropriate parts of Schedule C (Form 990) and attach Schedule C to Form 990.

0 kommentar(er)

0 kommentar(er)